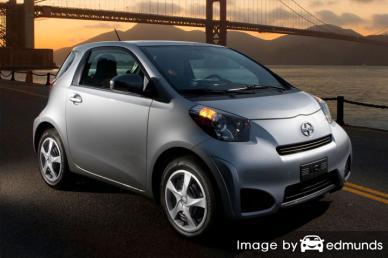

Would you prefer to buy more affordable Scion iQ insurance in Las Vegas? I can’t think of anyone who is fond of buying insurance, in particular when the cost is too high.

Would you prefer to buy more affordable Scion iQ insurance in Las Vegas? I can’t think of anyone who is fond of buying insurance, in particular when the cost is too high.

We don’t have to tell you that car insurance companies don’t want you shop around. Insureds who get price quotes annually are inclined to switch insurance companies because of the high probability of finding a lower-priced company. A study showed that drivers who shopped around every year saved on average $70 a month compared to other drivers who don’t regularly compare prices.

If finding the best price on Scion iQ insurance is your goal, then having a good understanding how to get rate quotes and compare cheaper coverage can help make the process easier.

Big-name insurance companies like State Farm, GEICO and Farmers Insurance continually hit you with advertising and it is challenging if not impossible to see past the geckos and flying pigs and do the work needed to find the best deal.

If you are paying for car insurance now, you will most likely be able to find the best rates using the techniques covered below. Buying the cheapest auto insurance in Las Vegas is actually quite simple. But Nevada car owners can benefit by having an understanding of the methods companies use to calculate your auto insurance rates because rates are impacted by many factors.

To find cheap prices, there are a couple of ways to compare rate quotes from local Las Vegas insurance companies. One of the best ways to lower the rate you pay for Scion iQ insurance is to use the internet to compare rates.

Online shopping is fast and free, and it makes it a waste of time to go to and from local Las Vegas insurance agencies. Quoting Scion iQ insurance online has made agencies unnecessary unless you’re the type of person who wants the extra assistance that only an agent can give. It is possible to price shop your coverage online but have a local agent actually write the policy.

Keep in mind that more quotes helps you find a lower rate than you’re paying now. Not every company provides online rate quotes, so you need to compare prices on coverage from those companies, too.

The auto insurance companies shown below can provide quotes in Las Vegas, NV. To locate the cheapest auto insurance in Las Vegas, NV, it’s a good idea that you visit several of them to get the best price comparison.

Las Vegas auto insurance discounts

Buying auto insurance is not cheap, but you might already qualify for some discounts that may help make it more affordable. Certain reductions will be credited when you get a quote, but some may not be applied and must be specially asked for prior to getting the savings.

- Pay Upfront and Save – By making one initial payment rather than spreading payments over time you can actually save on your bill.

- ABS Braking Discount – Cars with ABS and/or traction control can reduce accidents and earn discounts up to 10%.

- Theft Prevention System – Vehicles that have factory alarm systems and tracking devices are stolen less frequently and will qualify for a discount on a Las Vegas auto insurance quote.

- Drive Less and Save – Maintaining low annual mileage could qualify for better rates on cars that stay parked.

- Accident Waiver – This isn’t a discount exactly, but some insurance companies will forgive one accident without getting socked with a rate hike as long as you don’t have any claims for a particular time prior to the accident.

- Passive Restraints – Factory air bags or automatic seat belts may earn rate discounts of up to 25% or more.

- Cautious Driver Discount – Insureds who avoid accidents can save as much as half off their rates compared to rates paid by drivers with frequent claims.

Discounts reduce rates, but you should keep in mind that some credits don’t apply to all coverage premiums. Some only apply to the price of certain insurance coverages like liability, collision or medical payments. Despite the fact that it seems like you can get free auto insurance, auto insurance companies aren’t that generous.

To view insurers that provide some of the discounts listed above in Las Vegas, click here to view.

Should I have guidance from an agent?

Many people would rather sit down and talk to an agent and that is OK! A nice benefit of getting online price quotes is you may find the best rates and still have a local agent.

To help locate an agent, after submitting this simple form, the quote information is emailed to local insurance agents in Las Vegas who will give competitive quotes to get your business. You won’t even need to contact any agents since rate quotes are delivered straight to your inbox. You can most likely find cheaper rates and work with a local agent. If you have a need to get a comparison quote from one company in particular, you would need to go to their quote page to submit a rate quote request.

Finding the right insurer shouldn’t rely on just the premium amount. Ask your prospective agent these questions:

- Do they see any coverage gaps in your plan?

- Is working in the agency their full-time job?

- How long has their agency been open in Las Vegas?

- How would your car be valued if totaled?

- When do they do policy reviews?

- Will you work with the agent or an assistant?

- Does the agency support the community they serve?

When narrowing the list to find an insurance agent, there are a couple of types of insurance agents from which to choose. Insurance policy providers are considered either exclusive or independent.

Exclusive Agencies

Agents that choose to be exclusive generally can only insure with one company such as Allstate, State Farm and Farm Bureau. They are unable to give you multiple price quotes so they are skilled at selling on more than just price. Exclusive insurance agents are well trained on what they offer which can be an advantage.

Shown below are Las Vegas exclusive insurance agencies willing to provide rate quotes.

David Habart – State Farm Insurance Agent

2035 Village Center Cir #100 – Las Vegas, NV 89134 – (702) 851-2400 – View Map

Allstate Insurance: Sergio A Chavez

4676 W Charleston Blvd – Las Vegas, NV 89102 – (702) 462-9100 – View Map

Franco Vitiello – State Farm Insurance Agent

3370 S Hualapai Way #140 – Las Vegas, NV 89117 – (702) 648-6642 – View Map

Independent Agents (or Brokers)

These agents do not write with just one company and that is an advantage because they can write policies with multiple insurance companies enabling the ability to shop coverage around. To transfer your coverage to a different company, your policy is moved internally and the insured can keep the same agent.

If you need cheaper insurance rates, we recommend you get rate quotes from several independent insurance agents so that you have a good selection of quotes to compare.

Below are independent agents in Las Vegas who can help you get comparison quotes.

Bleecher Insurance

3085 S Jones Blvd – Las Vegas, NV 89146 – (702) 477-7776 – View Map

Harrison Insurance Agency

724 S 9th St – Las Vegas, NV 89101 – (702) 648-1634 – View Map

Las Vegas Auto Insurance

1953 N Decatur Blvd – Las Vegas, NV 89108 – (702) 570-5777 – View Map

Insuring your vehicle just makes sense

Even though it’s not necessarily cheap to insure a Scion in Las Vegas, paying for auto insurance is required by state law in Nevada and it also provides benefits you may not be aware of.

- Just about all states have mandatory insurance requirements which means you are required to buy specific minimum amounts of liability protection if you drive a vehicle. In Nevada these limits are 15/30/10 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you took out a loan on your iQ, more than likely the lender will require that you have physical damage coverage to ensure the loan is repaid in case of a total loss. If coverage lapses or is canceled, the bank or lender will purchase a policy for your Scion for a lot more money and require you to pay much more than you were paying before.

- Auto insurance preserves both your vehicle and your personal assets. It will also pay for all forms of medical expenses for both you and anyone you injure as the result of an accident. One of the most valuable coverages, liability insurance, will also pay to defend you if someone files suit against you as the result of an accident. If damage is caused by hail or an accident, collision and comprehensive (also known as other-than-collision) coverage will pay to have it repaired.

The benefits of buying enough insurance definitely exceed the cost, especially if you ever need it. The average driver in America is currently overpaying as much as $865 each year so shop around at every renewal to be sure current rates are still competitive.

Coverages available on your policy

Understanding the coverages of insurance aids in choosing appropriate coverage and the correct deductibles and limits. Insurance terms can be difficult to understand and coverage can change by endorsement. Below you’ll find the usual coverages available from insurance companies.

Collision coverage

This covers damage to your iQ from colliding with another car or object. A deductible applies and then insurance will cover the remainder.

Collision can pay for things like rolling your car, backing into a parked car, hitting a mailbox and sustaining damage from a pot hole. Paying for collision coverage can be pricey, so consider removing coverage from vehicles that are 8 years or older. Another option is to increase the deductible on your iQ to get cheaper collision coverage.

Liability car insurance

Liability insurance can cover damage that occurs to a person or their property. Liability coverage has three limits: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You might see limits of 15/30/10 that means you have a limit of $15,000 per injured person, a total of $30,000 of bodily injury coverage per accident, and a total limit of $10,000 for damage to vehicles and property.

Liability can pay for things like medical services, repair bills for other people’s vehicles, funeral expenses and emergency aid. The amount of liability coverage you purchase is a personal decision, but it’s cheap coverage so purchase as much as you can afford. Nevada requires drivers to carry at least 15/30/10 but you should consider buying higher limits.

The chart below demonstrates why minimum state limits may not be high enough to adequately cover claims.

Medical expense insurance

Personal Injury Protection (PIP) and medical payments coverage provide coverage for expenses for things like prosthetic devices, dental work, ambulance fees and funeral costs. They can be used to cover expenses not covered by your health insurance policy or if you do not have health coverage. Medical payments and PIP cover all vehicle occupants as well as being hit by a car walking across the street. PIP coverage is not an option in every state and may carry a deductible

Comprehensive (Other than Collision)

Comprehensive insurance will pay to fix damage that is not covered by collision coverage. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive coverage pays for things like rock chips in glass, damage from flooding, damage from a tornado or hurricane, hitting a deer and a tree branch falling on your vehicle. The highest amount you can receive from a comprehensive claim is the actual cash value, so if it’s not worth much more than your deductible it’s not worth carrying full coverage.

Protection from uninsured/underinsured drivers

Your UM/UIM coverage provides protection from other drivers when they do not carry enough liability coverage. Covered losses include injuries to you and your family as well as your vehicle’s damage.

Because many people only purchase the least amount of liability that is required (15/30/10), it only takes a small accident to exceed their coverage. So UM/UIM coverage is important protection for you and your family.

Find affordable auto insurance prices by comparing often

Affordable Scion iQ insurance in Las Vegas is attainable from both online companies and from local insurance agents, and you need to price shop both to have the best chance of lowering rates. Some insurance providers may not have the ability to get quotes online and usually these smaller companies work with independent agents.

As you prepare to switch companies, you should never buy poor coverage just to save money. There have been many cases where someone dropped liability coverage limits only to find out that saving that couple of dollars actually costed them tens of thousands. The ultimate goal is to get the best coverage possible at the best price but still have enough coverage for asset protection.

Steps to finding more affordable Scion iQ insurance in Las Vegas

If your goal is the lowest price, then the best way to find affordable quotes for Scion iQ insurance is to compare quotes annually from companies that sell auto insurance in Las Vegas.

Step 1: Try to learn about policy coverages and the things you can change to prevent expensive coverage. Many rating factors that increase rates like accidents, careless driving, and an imperfect credit score can be remedied by making small lifestyle or driving habit changes.

Step 2: Compare price quotes from direct, independent, and exclusive agents. Exclusive and direct companies can only quote rates from a single company like Progressive or State Farm, while agents who are independent can give you price quotes from multiple insurance companies.

Step 3: Compare the new rates to the price on your current policy and determine if there is any savings. If you can save some money and decide to switch, make sure there is no lapse between the expiration of your current policy and the new one.

Step 4: Provide adequate notice to your current company to cancel your existing policy and submit the application along with any required down payment for the new policy. As soon as you can, place the new certificate verifying proof of insurance above your visor, in the console, or in the glove compartment.

One key aspect when comparing rates is that you’ll want to make sure you compare the same physical damage deductibles and liability limits on every quote and and to get prices from as many auto insurance providers as possible. This provides a fair rate comparison and the best price quote selection.

More information is available at these links:

- Electronic Stability Control FAQ (iihs.org)

- How Much is Auto Insurance for Ride Shares in Las Vegas? (FAQ)

- Who Has the Cheapest Auto Insurance Quotes for Teachers in Las Vegas? (FAQ)

- What Auto Insurance is Cheapest for First-time Drivers in Las Vegas? (FAQ)

- Who Has Affordable Auto Insurance for a Hyundai Sonata in Las Vegas? (FAQ)

- Who Has Affordable Auto Insurance Rates for a 20 Year Old Male in Las Vegas? (FAQ)

- Auto Insurance 101 (About.com)

- Pickups fall short in headlight tests (Insurance Institute for Highway Safety)

- Crash Avoidance Technologies FAQ (iihs.org)