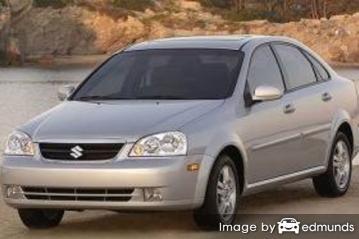

Trying to find the cheapest Suzuki Forenza insurance in Las Vegas? Sick and tired of paying out the nose to pay high insurance rates every month? You’re in the same situation as most other drivers in Nevada.

Trying to find the cheapest Suzuki Forenza insurance in Las Vegas? Sick and tired of paying out the nose to pay high insurance rates every month? You’re in the same situation as most other drivers in Nevada.

It’s well known that auto insurance companies don’t want you shop around. Consumers who shop around for the cheapest rate are highly likely to switch to a new company because they have good chances of getting low-cost coverage. A study showed that drivers who make a habit of shopping around saved $860 a year as compared to drivers who never shopped around for cheaper prices.

If finding the lowest price on car insurance in Las Vegas is why you’re here, learning the best way to quote and compare insurance premiums can make it easier to shop your coverage around.

Having so many insurance providers from which to choose, it is hard for the average consumer to locate the lowest price insurance company.

It’s a good habit to compare rates on a regular basis due to the fact that insurance prices are variable and change quite frequently. Despite the fact that you may have had the lowest rates on Suzuki Forenza insurance in Las Vegas six months ago there is a good chance you can find better rate quotes now. Block out anything you think you know about insurance because you’re about to find out the fastest and easiest way to save money, get proper deductibles and limits, all at the lowest rate.

Pricing the lowest-priced insurance policy in Las Vegas is not as hard as you think. Basically, everyone who comparison shops for insurance will more than likely be able to cut their insurance bill. But Nevada vehicle owners do need to understand how the larger insurance companies sell insurance online and use it to your advantage.

Six factors that impact insurance premiums

Lots of things are used when quoting car insurance. Some factors are common sense such as traffic violations, although some other factors are more transparent such as your marital status or how financially stable you are. Part of the auto insurance buying process is learning the different types of things that go into determining the level of your policy premiums. When you know what positively or negatively influences your rates, this helps enable you to make changes that could result in better auto insurance rates.

Occupation can influence premiums – Did you know your career choice can influence rates? Careers such as judges, business owners, and financial analysts generally pay higher average rates due to high stress and lengthy work days. On the flip side, occupations such as professors, athletes and performers have lower than average premiums.

More policies can equal more savings – Most major auto insurance companies provide lower prices to people that buy multiple policies, otherwise known as a multi-policy discount. The discount can be ten or even up to twenty percent in some cases. Even if you’re getting this discount drivers will still want to compare other company rates to confirm you are receiving the best rates possible.

Cheaper rates for prior coverage – Having a lapse in insurance coverage can be a fast way to trigger a rate increase. In addition to paying higher premiums, getting caught without coverage may result in a hefty fine and possibly a revoked license.

Discounts for married couples – Having a wife or husband helps lower the price when shopping for auto insurance. Having a significant other means you’re more financially stable and statistics prove being married results in fewer claims.

Remove unneeded add-on coverages – Insurance companies have many optional add-on coverages you can purchase on your Forenza policy. Things like coverage for rental cars, death and dismemberment, and extra life insurance coverage may not be needed and are just wasting money. The coverages may be enticing when you first buy your policy, but if you’ve never needed them in the past eliminate them to save money.

Where you reside is a factor – Having an address in small towns and rural areas has definite advantages if you are looking for the lowest rates. Fewer drivers means less chance of accidents and also fewer theft and vandalism claims. People who live in big cities have to deal with congested traffic and a longer drive to work. More time commuting can result in more accidents.

Get discounts on Las Vegas auto insurance

Insurance can be prohibitively expensive, but there are discounts available that may help make it more affordable. Certain credits will be shown when you purchase, but some must be specially asked for prior to receiving the credit.

- Discount for Home Ownership – Just being a homeowner can save a few bucks because it means you have a higher level of financial diligence.

- Onboard Data Collection – Insureds who allow data collection to scrutinize vehicle usage by using a telematic data system such as Allstate’s Drivewise and State Farm’s In-Drive system may see discounts if their driving habits are good.

- College Student – Kids who live away from home at college and do not have a car could qualify for this discount.

- Life Insurance – Some insurance carriers give a discount if you purchase a life insurance policy as well.

- Military Deployment Discount – Having an actively deployed family member could be rewarded with lower rates.

- Paper-free Discount – A handful of larger companies may give you up to $50 shop Las Vegas auto insurance online.

- Senior Discount – Drivers that qualify as senior citizens can get reduced rates.

- Club Memberships – Being a member of a qualifying organization is a simple method to lower premiums when shopping for auto insurance.

As a disclaimer on discounts, some of the credits will not apply to your bottom line cost. Most only reduce individual premiums such as comp or med pay. So even though it sounds like you can get free auto insurance, that’s just not realistic.

Popular auto insurance companies and some of the premium reductions they offer include:

- State Farm includes discounts for passive restraint, Drive Safe & Save, defensive driving training, good driver, student away at school, and driver’s education.

- GEICO may offer discounts for federal employee, anti-theft, military active duty, membership and employees, anti-lock brakes, seat belt use, and multi-policy.

- Progressive has discounts for multi-vehicle, online quote discount, multi-policy, online signing, and good student.

- 21st Century policyholders can earn discounts including air bags, student driver, homeowners, driver training, and good student.

- American Family may have discounts that include bundled insurance, mySafetyValet, defensive driver, Steer into Savings, accident-free, and good student.

- The Hartford offers discounts for anti-theft, driver training, good student, defensive driver, and vehicle fuel type.

- AAA offers discounts including education and occupation, multi-car, pay-in-full, AAA membership discount, good driver, anti-theft, and multi-policy.

Before purchasing a policy, check with all companies you are considering how many discounts you can get. Savings may not apply to policies in every state.

Best auto insurance in Las Vegas

Insuring your vehicle with the highest-rated company is difficult considering how many companies provide coverage in Las Vegas. The rank data in the next section may help you decide which insurers you want to consider comparing price quotes from.

Top 10 Las Vegas Car Insurance Companies by A.M. Best Rank

- USAA – A++

- Travelers – A++

- GEICO – A++

- State Farm – A++

- The Hartford – A+

- Esurance – A+

- Nationwide – A+

- Allstate – A+

- Mercury Insurance – A+

- Titan Insurance – A+

Top 10 Las Vegas Car Insurance Companies Overall

- USAA

- American Family

- State Farm

- The Hartford

- AAA Insurance

- GEICO

- The General

- Titan Insurance

- Progressive

- Mercury Insurance

Be persistent to save money

As you go through the steps to switch your coverage, it’s not a good idea to skimp on coverage in order to save money. There are a lot of situations where an insured dropped liability coverage limits only to find out that the small savings ended up costing them much more. Your goal is to find the BEST coverage at a price you can afford, not the least amount of coverage.

Consumers leave their current company for a variety of reasons including lack of trust in their agent, high rates after DUI convictions, extreme rates for teen drivers and being labeled a high risk driver. It doesn’t matter what your reason, finding the right auto insurance provider is not as hard as you think.

Cheap Suzuki Forenza insurance in Las Vegas is possible both online and from local insurance agents, so you need to shop Las Vegas auto insurance with both to have the best selection. Some companies may not provide internet price quotes and usually these smaller providers sell through independent agents.

How to find discount Suzuki Forenza insurance in Las Vegas

The easiest way to get cheaper auto insurance rates in Las Vegas is to make a habit of comparing prices annually from companies who sell auto insurance in Nevada.

- Step 1: Try to comprehend the coverage provided by your policy and the modifications you can make to lower rates. Many factors that result in higher prices like speeding tickets, careless driving and an unacceptable credit history can be rectified by improving your driving habits or financial responsibility.

- Step 2: Quote rates from independent agents, exclusive agents, and direct companies. Exclusive agents and direct companies can only quote rates from a single company like Progressive or Allstate, while independent agents can quote prices from many different companies. View prices

- Step 3: Compare the new quotes to your current policy premium and see if you can save money. If you can save some money and buy the policy, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Step 4: Provide written notification to your current company to cancel your current coverage. Submit the required down payment along with the signed application to your new insurance company. Don’t forget to put the proof of insurance certificate somewhere easily accessible.

A crucial key to this process is to use the same amount of coverage on every quote request and and to get prices from as many companies as you can. This guarantees the most accurate price comparison and a good representation of prices.

For more information, link through to the articles below:

- Five Steps to Filing an Auto Insurance Claim (Insurance Information Institute)

- Who Has Cheap Car Insurance Quotes for Low Credit Scores in Las Vegas? (FAQ)

- Who Has the Cheapest Las Vegas Auto Insurance for a 20 Year Old Female? (FAQ)

- What Auto Insurance is Cheapest for First-time Drivers in Las Vegas? (FAQ)

- How to Avoid Staged Accidents (State Farm)

- New head restraint design cuts injuries (Insurance Institute for Highway Safety)

- Things to Know Before you Cancel Insurance (Allstate)

- Credit and Insurance Scores (Insurance Information Institute)